Insolvency & Bankruptcy Code (IBC), 2016 consolidate and amend the laws relating to reorganisation and insolvency resolution of corporate persons, partnership firms and individuals by way of alternation in the order of government dues. The process should be completed in a time bound manner for maximisation of value of assets of such persons which leads to promote entrepreneurship and to increase the availability of credit.

Out of dirty dozen cases only one i.e. Bhushan steel is completed after lapse of 293 days from the date of the commencement i.e. July 26, 2017, this is in spite of lot many hurdles and also last ditch effort by the present promotors to not lose control, in a way it’s commendable because considering grace period of 90 days under the law delay is only 23 days, further lenders got cash on the date of settlement and also 12% stake in the company. As the company goes into the strong hands it will promote entrepreneurship and safeguard interests of all the stakeholders. No doubt lenders getting Rs 35,200 crores, it will increase availability of credit and will benefit the economy on a larger scale.

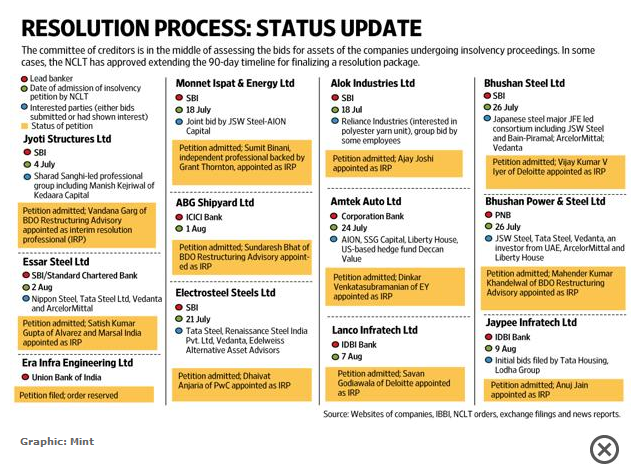

Figure 1: Status as of Jan 2018 (Source – www.livemint.com)

Lessons learned

- Collection and verification of claims: It is one of the crucial task in the hand of IRP, based on that COC will be formed and order of payment will be decided, while verifying claims there may be chances of frivolously claims by the creditors or any creditor raising any dispute and going into litigation for accepting his determined claim and unnecessary delays the process, as happened in present case where L&T filed an application to NCLT as an operational creditor against its dues to be considered as secured and included in the resolution plan accordingly, which was rejected by the NCLT.

- Resolution Professional Acumen: To complete the process within the time and by considering the interest of all stakeholders, resolution professional plays an important part. In Bhushan steel case, IRP, as proposed subsequently appointed as Resolution Professional, played an important role, he has been handed with the responsibility of running the company as a going concern and securing the assets of the debtor and to perform such duties an Insolvency professional one needs a strong support system, infrastructure, ability to appoint lawyers, valuers and other professional, which clearly reflected in this case.

- Resolution applicant: A company can be revived by not just putting funds into it but by the successor’s capability to run the business efficiently from its experience. If resolution applicant is from the different line of business than that of a corporate debtor, then sustainability of going concern in long term should also be looked in.

- Continuous revision/ updation in the law: CRIP against Bhushan Steel initiated in July 2017, post that IBC, 2016 has gone through many changes in its provisions, major being disqualification of defaulting promoters from putting resolution plan by incorporating Sec 29A -Person not eligible to be resolution applicant and “selling company as a going concern” in case of liquidation and other updates due to regular judicial decision, hence an Insolvency Professional must always be updated while performing his duties as an IRP or RP to avoid any litigation due to such change in code and unnecessary delaying the process.

Conclusion:

The basic intention of the Code is always being revival of the company rather than letting it go for liquidation to recover the debts. Timeline is one of the essence of this code and it is proving challenging to maintain the same in present scenario in case of large defaulting companies due to various complex structure, intense bidding by competitors for the assets of the company and challenging COC decision before court in case of rejection of their bids which further extend the process time.

Win-win situation will be achieved only when the best interest of the company and its future is looked into rather than the best interest of the financial creditors even though recovery of stress assets is essential for the economy.

Main Contributor: Pritam Sangwan (@sangwan_pritam)